The year 2020 shook California’s wine industry to its core. Challenges from the COVID-19 pandemic, ensuing quarantines, and wildfires tested the staying power of even the largest wineries. Now the wine industry faces a more considerable and more long-term challenge as the traditional insurers of wineries exit the business. Once one of the darlings of commercial insurance has degenerated into a handful of insurers with a take it or leave it attitude and large premium increases.

Wildfire!

In the simplest of terms, the wine industry lives in a symbiotic relationship with the land on which it exists. Although the risk of wildfire has always existed in California, as the size and number of wineries in high-risk areas doubled, the potential for insurance providers’ catastrophic claims increased.

Just as the wine industry had adjusted to the new COVID-19 operating routines and was getting ready for harvest, an old foe resurfaced. This time the wildfires were more extensive and more destructive. Napa burned twice! There was a time in August that most counties in California were on fire. The insurance providers held their collective breaths and got out their checkbooks. This time buildings and inventory burned, businesses were lost, and damaged many of the 2020 wine grape harvests. The insurers of wineries in California were in panic mode.

Unfortunately, areas that escaped fire damage, i.e., Temecula, Santa Barbara, Paso Robles, to mention a few, were suddenly looked to as the next fire victims and were caught up in the broad-brush stroke of tightening insurance underwriting guidelines. More insurance providers have or are planning to exit the marketplace. There were at least fifteen insurance companies writing winery insurance at the beginning of 2020. As of January 2021, six have left the market, with four more seriously reviewing their position.

What next?

Some of the changes you can expect to see in 2021 include locations becoming uninsurable, stop-loss limits, large rate increases for property, as well as auto and excess liability coverages. Insurers now use various third-party services to map areas for fire risk. Sometimes irrational and not always indicative of your individual location these fire risk indicators are the new bible for insurance providers if you have a site that scores above their maximum threshold, no insurance, period!

The second concern is the concentration of values. If the total value of buildings, property, and wine stock exceeds whatever limit the insurer’s underwriting allows, you may only be offered a specified limit commonly known as a “stop-loss” limit. Insurers usually only carry part of the property value in the house and use a reinsurance provider for the rest. Reinsurance for winery risks has all but disappeared, forcing insurers to absorb the entire risk, pay huge reinsurance fees, or decline to write the policy.

What are your options?

For years wineries have used experts for most components of their business- barrels, bottling, compliance, etc., but many still choose to get their risk management and insurance advice from their neighborhood agency that only writes a handful of local wineries. Considering previous trends and future predictions, this will not work for 2021 and beyond; specialists are now essential. Using a specialist who understands the market and the intricacy of a winery’s operation can be the difference between having insurance or going unprotected.

If you need to talk to an expert

[button size=’medium’ style=” text=’Click Here’ icon=” icon_color=” link=’/contact’ target=’_self’ color=” hover_color=” border_color=” hover_border_color=” background_color=’#4d4135′ hover_background_color=” font_style=’normal’ font_weight=’300′ text_align=” margin=”]

or call us at (805) 593-1412

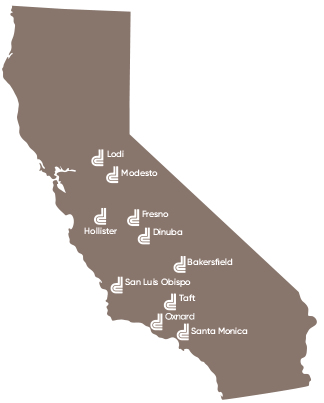

Authored by Kevin Lynn of DiBuduo & DeFendis, D&D Beverage Group

Kevin Lynn has been Program Manager for the D&D Beverage group since joining the company in 2015. He is responsible for working with vineyard, winery, and brewery clients to help them solve daily business operations challenges. With a degree in Agribusiness and experience in the operation of vineyards and wineries, Kevin brings his real-life experiences to the team. D&D Beverage Group offers a wealth of knowledge for growers, vintners, and brewers, from crop insurance to worker safety and employee benefits.